The top 10 dental insurance companies offer a mix of value, coverage options, and customer satisfaction. Popular choices include Delta Dental, MetLife, and Cigna for their diverse plans and nationwide availability.

Securing dental insurance is essential for maintaining good oral health without financial strain. These top insurers provide various plans to fit individual needs, from basic preventive care to extensive procedures. Consumers can enjoy peace of mind knowing their dental needs are covered, whether they require routine check-ups, cleanings, or more complex treatments.

With the rising costs of dental procedures, having insurance is a smart financial move. It allows for better planning and management of dental expenses, optimizing oral health while keeping budgets in check. Therefore, selecting the right insurance provider is not only a health priority but also a crucial financial decision.

Smiling Toward The Future: The Role Of Dental Insurance

Imagine a future where toothaches and dental costs don’t scare you. Dental insurance plays a vital role in making this vision real. It’s not just about handling dental issues as they come. It’s about knowing you’re covered, which gives you the confidence to smile, today and tomorrow. With the right plan, unexpected dental problems won’t put a dent in your savings.

A Bite Into Dental Insurance Benefits

Dental insurance brings peace of mind and can lead to better overall health. Here are the key benefits:

- Preventive Care: Regular check-ups and cleanings are often fully covered.

- Cost Savings: Save money on pricey procedures with dental coverage.

- Health Investment: Oral health impacts your entire body, and dental insurance encourages routine care.

- Budget Management: Predictable monthly premiums and no surprise bills.

Pearly Whites Protection: What’s Covered?

Let’s talk about what dental insurance typically includes:

| Type of Service | Typically Covered? |

|---|---|

| Preventive Care (Exams, X-Rays, Cleanings) | Yes, often at 100% |

| Basic Procedures (Fillings, Extractions) | Yes, a large percentage |

| Major Procedures (Crowns, Bridges, Dentures) | Yes, but a lower percentage |

| Orthodontic Treatment | Varies by plan |

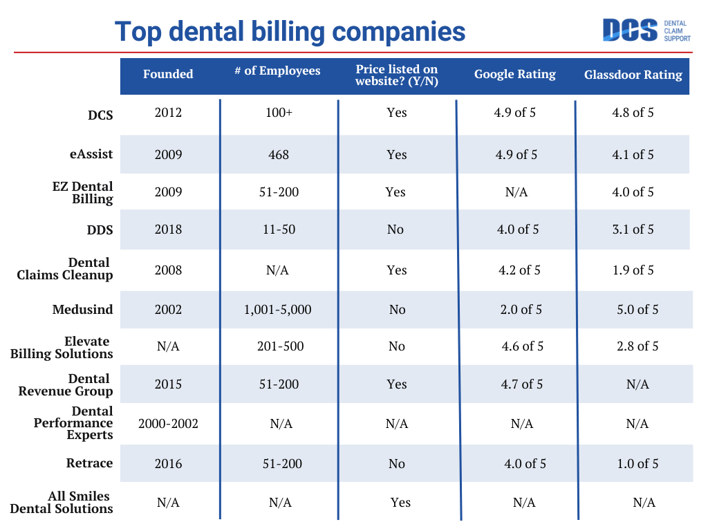

Credit: www.dentalclaimsupport.com

Navigating The Marketplace: Choosing The Right Plan

Shining A Light On The Top 10 Dental Insurance Providers

Finding the right dental insurance can be a bright spot in maintaining your smile. It’s important. A good plan can save you from unexpected dental costs. Let’s explore the leading options available.

Leaders In Coverage Options

When seeking dental insurance, diverse coverage options matter. We’ve cut through the complexity to spotlight providers offering a variety of plans, ensuring you can find a perfect match for your needs. Consider providers like Delta Dental and MetLife, known for their extensive range of plans, catering to different budgets and requirements.

- Delta Dental: Varieties of HMO and PPO plans.

- MetLife: Flexible plans for individuals and families.

- …and other leaders delivering exceptional coverage diversity.

Consumer Experiences And Reviews

Real customer feedback lights the path to trustworthy providers. Top-rated companies based on consumer reviews illustrate customer satisfaction. Look to reviews for insights on customer service, claim handling, and overall satisfaction. Providers like Cigna and Aetna often shine in consumer reviews.

Add additional rows as needed| Provider | Customer Service Rating | Claim Handling |

|---|---|---|

| Cigna | 4.5/5 | Positive |

| Aetna | 4/5 | Efficient |

Credit: www.marketwatch.com

Beyond The Brush: Additional Benefits Of Premium Policies

Dental insurance is not just about regular check-ups and emergency treatments. Premium plans often encompass more than the basics. These policies can extend beyond the common scope, adding value and coverage for diverse dental needs. Discover the hidden advantages that can help maintain not just oral health, but also contribute to a vibrant smile.

Orthodontics And Cosmetic Dentistry Add-ons

While basic policies tend to cover preventive care, premium dental insurance often includes orthodontic and cosmetic dentistry benefits. For families with children or adults seeking to enhance their smile, these add-ons become essential.

- Braces coverage for both children and adults

- Discounts on Invisalign treatments

- Veneers, whitening services, and other cosmetic enhancements

Innovative Features And Wellness Programs

Top-tier plans often cater to overall wellness with features designed to promote dental health. These innovative benefits support a proactive approach to maintaining a healthy smile.

| Feature | Benefit |

|---|---|

| Smartphone app support | Appointment reminders and oral health tips |

| Teledentistry services | Virtual consultations and follow-ups |

| Oral health trackers | Gadgets and apps that monitor brushing habits |

Such plans may also offer wellness programs focusing on early detection and prevention of dental issues. Members might enjoy perks such as:

- Free annual oral cancer screenings

- Access to a network of top-rated specialists

- Discounts on popular oral care products

Sealing The Deal: Tips For Maximizing Your Dental Insurance

Sealing the Deal: Tips for Maximizing Your Dental Insurance

Getting the most out of your dental insurance takes a bit of know-how. Each plan offers unique benefits and understanding them can save you money. Grasp the full potential of your dental coverage with these handy tips. Keep your smile bright and your wallet happy!

Smart Use Of Annual Maximums

Know your annual maximums.

These are caps on what your insurance pays within a year. Plan treatments to use the full benefit without waste. Consider timing—use your max before the year’s end. Don’t leave money on the table.

Preventive Care Strategies

Frequent check-ups help you save on treatments later.

Insurances often cover cleanings and regular exams in full. Take advantage of these benefits. They keep your teeth healthy. This means less need for costly procedures in the future. Prevention is better than cure.

Credit: www.benefitnews.com

Frequently Asked Questions Of Top 10 Dental Insurance

What Is Covered By Dental Insurance?

Dental insurance typically covers preventive care like cleanings, exams, and X-rays, basic procedures like fillings and extractions, and sometimes major services like crowns or bridges.

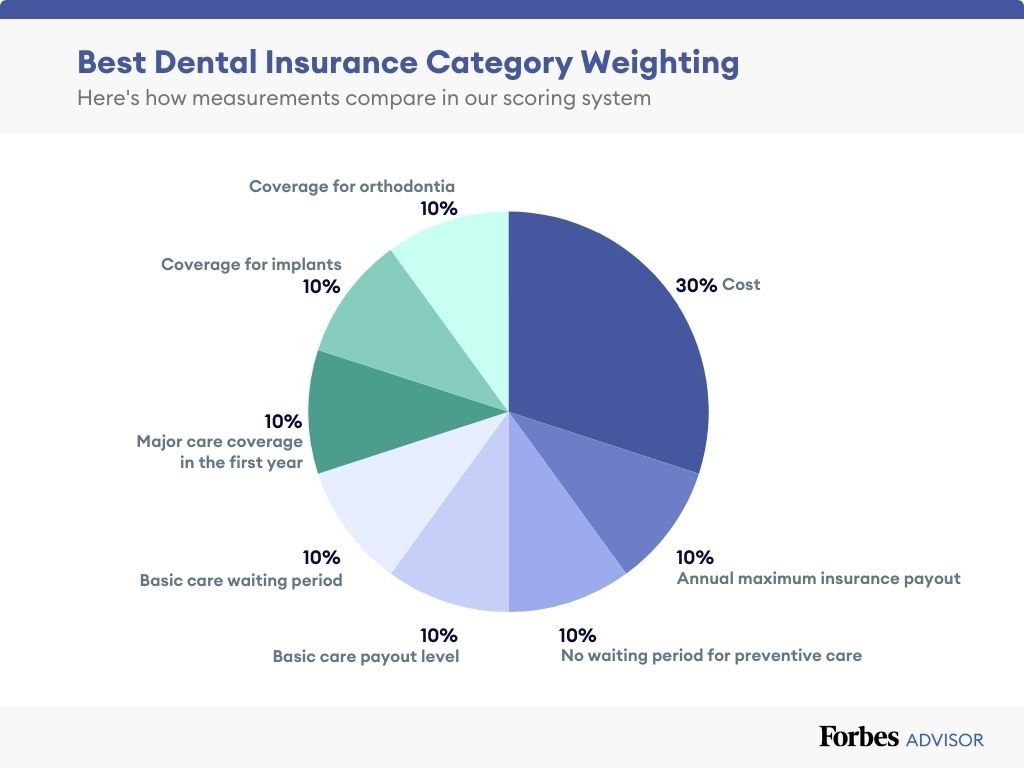

How To Choose The Best Dental Insurance?

Look for a plan that balances affordable premiums with low deductibles, covers a wide network of dentists, and includes the specific treatments that meet your dental care needs.

Are There Dental Plans Without Waiting Periods?

Yes, some dental insurance plans offer immediate coverage without waiting periods, allowing you to access benefits for certain treatments right after your policy starts.

Conclusion

Selecting the right dental insurance is crucial for maintaining oral health without breaking the bank. Our top 10 picks offer a variety of options tailored to meet different needs and budgets. Remember, the best plan for you balances comprehensive coverage with affordable premiums.

Research pays off—choose wisely for a healthy smile!