Top 10 dental insurance plans for implants often include Cigna, Delta Dental, and Aetna. These provide varying levels of coverage for dental implants.

Searching for the best dental insurance for implants can be challenging, with many factors to consider, such as coverage limits, deductibles, and premiums. Dental implants are a popular yet expensive procedure, not always covered by standard dental insurance plans. Selecting the right insurance requires a thorough comparison of plan details, understanding of waiting periods, and knowledge of what portion of the implant procedure—surgery, the post, and the crown—is covered.

Consumers seek plans that offer the most comprehensive coverage for implants at a reasonable cost, leading to efficient oral healthcare management. As treatments like dental implants become more common, insurance providers are increasingly offering plans that cater specifically to these high-cost dental services, ensuring that patients can afford the essential care they need without facing formidable out-of-pocket expenses. Choosing the right dental insurance plan can make a significant difference in the accessibility and affordability of dental implants.

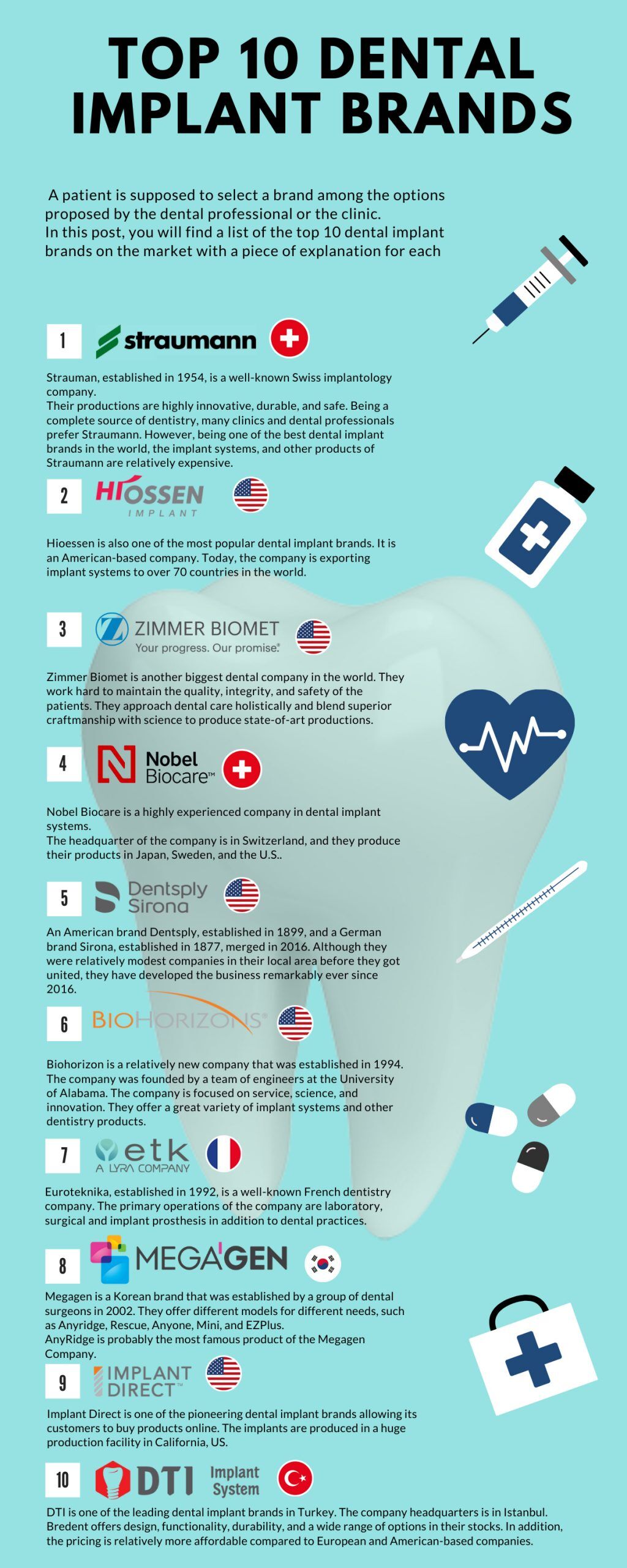

The Necessity Of Dental Implants

Dental implants act as a cornerstone for robust oral health. Their role extends beyond mere cosmetics; they provide functionality and comfort that traditional dentures or bridges often lack. Healthy teeth are vital for nutrition and confidence. When tooth loss occurs, dental implants can be the game-changer. They not only preserve facial structure but also improve your smile and chewing ability. Let’s delve into why the demand for dental implants is on the rise and what makes them a preferred choice.

Growing Demand For Dental Restoration

Trends show an uptick in people opting for dental implants. Reasons range from tooth decay to injuries. Here’s why implants are soaring in popularity:

- Innovations in dentistry make implants more accessible and effective.

- Aging populations need lasting dental solutions.

- People seek permanent fixtures rather than removable prosthetics.

Long-term Benefits Over Dentures And Bridges

Unlike dentures and bridges, dental implants come with a host of advantages:

- Implants prevent bone loss, maintaining jawbone integrity.

- They don’t shift or slip, providing stability.

- Implants can last a lifetime with proper care.

These are just a few reasons why implants top traditional alternatives. When it comes to teeth, opt for a lifetime of smiles with the superior choice – dental implants.

Credit: www.riversideoralsurgery.com

Evaluating Dental Insurance Options

Evaluating dental insurance options is crucial for individuals considering dental implants. With a variety of plans on the market, selecting the right one can substantially affect your wallet and your smile. Understanding the specific coverages and exclusions of dental insurance for implants is the first step to making an informed decision.

Coverage Details For Implant Procedures

The scope of coverage for dental implants varies across different insurance providers. It’s essential to examine the following points:

- Percentage of coverage: What portion of the implant cost does the insurance cover?

- Annual maximums: How much will the insurance pay in a calendar year?

- Waiting periods: Is there a timeframe you must wait before implant coverage kicks in?

- Pre-existing conditions: Are implants for pre-existing conditions covered?

| Insurance Provider | Percentage Covered | Annual Maximum | Waiting Period |

|---|---|---|---|

| Provider A | 50% | $2,000 | 6 months |

| Provider B | 60% | $1,500 | None |

Understanding Insurance Limitations And Exclusions

Every dental insurance plan has limitations and exclusions. Be sure to note:

- Exclusion period for implants: Some insurances exclude implants for a certain period after enrollment.

- Type of implants covered: Does the insurance cover both endosteal and subperiosteal implants?

- Frequency limits: How often can you have implant procedures covered?

By paying attention to these limitations and exclusions, you can avoid unexpected out-of-pocket expenses.

Top 5 Dental Insurance Plans For Implants

Finding an insurance plan that covers dental implants is crucial for affordable oral health care. Implants can be costly, but the right plan can lower out-of-pocket expenses. A comprehensive dental insurance can turn the dream of a perfect smile into reality. Review the top five dental insurance plans to find the best coverage for implants.

Plan Comparison By Coverage

Understanding your coverage options is essential. Let’s look at the top dental insurance plans and how they help with implants.

| Insurance Plan | Implant Coverage | Waiting Period | Annual Maximum |

|---|---|---|---|

| DentalGuard Preferred | 50% | 12 months | $1,500 |

| Delta Dental PPO | Partial | 6 months | $1,000 |

| Cigna Dental 1500 | 50% | None | $1,500 |

| Aetna Vital Savings | Discounts | None | N/A |

| MetLife TakeAlong Dental | Varies | 24 months | $1,000 – $3,000 |

Cost-benefit Analysis For Each Plan

Analyzing the cost against benefits for each plan makes the choice simpler. Consider premium costs, deductibles, and coverage percentages.

- DentalGuard Preferred: High premiums, but best for full coverage needs.

- Delta Dental PPO: Affordable with moderate coverage, worth it for those on a budget.

- Cigna Dental 1500: No waiting period is a big plus. Ideal for immediate needs.

- Aetna Vital Savings: Not traditional insurance, but offers significant implant discounts.

- MetLife TakeAlong Dental: Offers tiered options for various budgets and needs.

How To Maximize Your Insurance Benefits

Dental implants can significantly improve your quality of life, but they can also be expensive. Understanding how to maximize your dental insurance benefits is crucial to getting the most out of your plan. Explore ways to navigate pre-approvals, handle waiting periods, and effectively utilize annual maximums to ensure your dental implant procedures are as affordable as possible.

Navigating Pre-approvals And Waiting Periods

- Check with your insurer to see if pre-approval is necessary for implants.

- Request a written pre-approval to avoid unexpected costs.

- Understand the terms of your policy, including waiting periods that may apply.

- Consider timing — schedule your implant procedure after the waiting period to maximize coverage.

- Stay organized by keeping a detailed record of all communications with your insurer.

Effective Utilization Of Annual Maximums

Dental insurance plans often have an annual maximum. This is the most they will pay within a year. Here’s how to use those maximums wisely:

- Start with a cost estimate from your dentist for the total implant procedure.

- Plan treatments across multiple years to use more than one annual maximum.

- If your treatment spans over two years, schedule the initial part at the end of the first year and the remainder at the start of the next year to take advantage of back-to-back annual maximums.

- Keep track of claims and remaining benefits to avoid exceeding the maximum.

Following these steps helps reduce out-of-pocket expenses, making dental implants more accessible and affordable with your insurance plan.

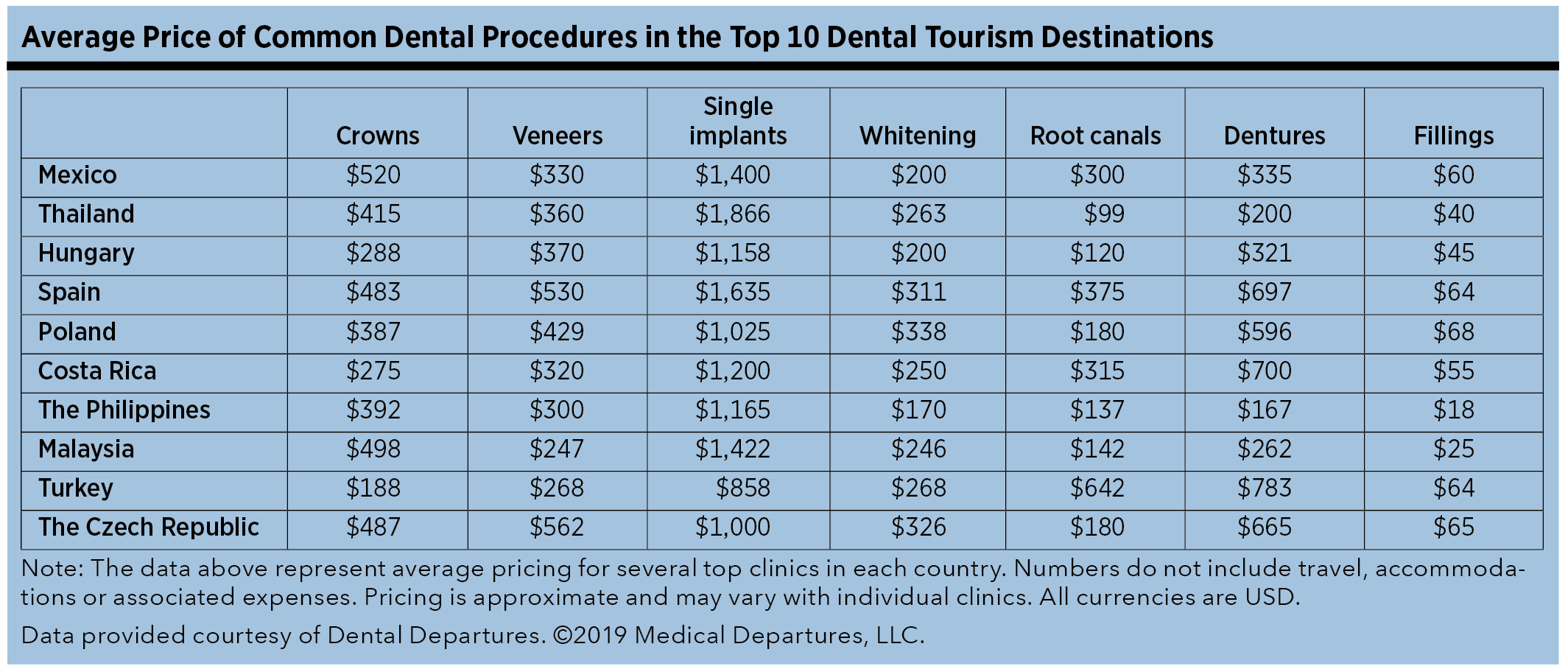

Alternatives If Dental Insurance Falls Short

Finding a dental insurance plan that fully covers implants can be challenging. When your plan doesn’t cover the full cost, you have options. Let’s explore some practical alternatives to ensure your smile gets the care it needs without breaking the bank.

Financing Dental Implants Without Insurance

Payment plans offer a way to break down the cost of dental implants into manageable monthly payments. Many dental offices have in-house financing options. These do not require an insurance provider. Credit companies also specialize in medical financing. Companies like CareCredit provide loans for medical expenses, sometimes with promotional interest-free periods.

Consider using a personal loan from your bank or credit union for dental work. Look for loans with low-interest rates and terms that fit your budget.

Exploring Discount Plans And Dental Savings

A dental discount plan operates differently than insurance. You pay an annual fee and get access to reduced rates on dental procedures. Make sure to check the list of included procedures. These plans often provide savings on implants.

Dental savings accounts can also help. Set aside funds in a Health Savings Account (HSA) or Flexible Spending Account (FSA), if you’re eligible. Use these pre-tax dollars to pay for your implants.

| Option | Benefits |

|---|---|

| Payment Plans | Breaks up cost, sometimes interest-free |

| CareCredit | Medical loans with promotional periods |

| Personal Loans | Flexible terms, may have lower rates |

| Discount Plans | Reduced rates on procedures |

| Savings Accounts (HSA/FSA) | Use pre-tax dollars for payments |

Credit: www.agd.org

Credit: www.forbes.com

Frequently Asked Questions For Top 10 Dental Insurance For Implants

What Are The Best Dental Insurance For Implants?

Choosing the best insurance for dental implants depends on coverage limits, copayments, and network of dentists. Consider consulting with insurers or reading policy details before selecting.

How Does Dental Insurance Cover Implant Procedures?

Dental insurance may cover a portion of the cost of implants, including the surgery and the crown, but often has a cap on coverage amounts and may not cover the full procedure.

Can I Get Full Coverage For Dental Implants?

Full coverage for dental implants is rare; most insurance plans will provide partial coverage, often subject to annual limits and potentially higher premiums.

Conclusion

Selecting the right dental insurance for implants can be a game-changer for your oral health and your wallet. With our top picks, you’re now equipped to make an informed choice that suits your needs. Prioritize your smile; invest in a plan that secures your dental future today.

Remember, a robust dental insurance for implants is not just a safety net – it’s a foundation for a healthy, confident you.