The best dental insurance for dentures typically offers generous coverage for prosthetics. It also provides a wide network of dentists and affordable premiums.

Securing the right dental insurance is essential for those requiring dentures, whether due to age, tooth loss, or medical conditions. Such insurance can alleviate the financial burden of these often costly dental appliances, ensuring that you can maintain a healthy and confident smile without incurring excessive out-of-pocket expenses.

Choosing a plan involves considering factors like annual maximums, deductibles, copayments, and waiting periods. As dentures are a significant investment, finding a plan that balances costs with comprehensive coverage is critical. Reliable dental insurance that covers dentures helps patients access necessary dental care, thus contributing to overall health and well-being.

Navigating Dental Insurance For Dentures

Getting dentures can be a big step towards a happy smile. Yet, many find the cost intimidating. Dental insurance can help, but it’s key to know how it works for dentures.

Assessing Your Denture Needs

Before diving into insurance details, figure out what you need. Dentists offer various types of dentures. Full or partial dentures, immediate or conventional ones.

- Full Dentures: Replace all teeth on the upper or lower jaw.

- Partial Dentures: Fill in gaps when just some teeth are missing.

- Immediate Dentures: Inserted the same day as teeth removal.

- Conventional Dentures: Placed after the mouth fully heals.

Consider comfort, durability, and budget when choosing. Dentists may also suggest over-dentures or implants-supported variations, which can affect cost and coverage.

Understanding Insurance Terms

Insurance policies use specific jargon. Get familiar with these to make informed choices:

- Premium:

- The cost you pay, monthly or yearly, for insurance coverage.

- Deductible:

- The amount paid out-of-pocket before insurance kicks in.

- Co-payment:

- A fixed fee for each visit or service, with insurance covering the rest.

- Co-insurance:

- After the deductible, the percentage of the cost shared with the insurer.

- Annual Maximum:

- The cap on what your insurance will pay within a year.

- Pre-existing Conditions:

- Any dental issues before coverage that may limit or exclude benefits.

- Waiting Period:

- Time you must wait after buying a plan before coverage starts.

Top Dental Insurance Plans Offering Denture Coverage

Finding the right dental insurance for dentures is crucial for maintaining a healthy smile without breaking the bank. A variety of plans offer comprehensive denture coverage to ensure your dental needs are met. Dive into the best dental insurance options that help you save on denture costs while enjoying the benefits of a full smile.

Comparing Premiums And Deductibles

Exploring insurance plans starts with understanding premiums and deductibles. Premiums are what you pay monthly for your coverage. Deductibles are out-of-pocket expenses before your insurance kicks in. Let’s compare:

| Insurance Plan | Monthly Premium | Annual Deductible |

|---|---|---|

| Plan A | $30 | $50 |

| Plan B | $25 | $100 |

| Plan C | $20 | $150 |

Look for plans with lower premiums if you’re on a budget, but consider the deductible carefully. Sometimes a higher deductible means lower monthly costs.

Reviewing Coverage Limits

Limits on coverage could affect how much you pay. Some plans include caps on how much they will pay annually. See the differences:

- Plan A: $1,500 annual limit

- Plan B: $1,000 annual limit with exceptions for dentures

- Plan C: No annual limit but with a waiting period for denture coverage

Check if limits reset each year. Choose a plan that doesn’t restrict your denture needs. Plans that offer higher or no limits could be more beneficial.

Maximizing Benefits With In-network Providers

Choosing in-network providers is the smart way to make the most out of your dental insurance for dentures. In-network dentists have agreed on discounted rates with your insurer, ensuring you pay less out-of-pocket. This step is crucial for cost-effective dental care. Stay within your plan’s network to reduce expenses significantly.

Finding Dentists in Your Plan’s Network

Finding Dentists In Your Plan’s Network

Locating a dentist within your insurance network is simple. Most insurance providers offer online directories.

- Visit your insurer’s website.

- Navigate to their provider directory.

- Filter results based on location and specialization.

Always confirm the provider’s network status by calling their office. This double-check prevents any unexpected costs.

The Importance of Pre-authorization

The Importance Of Pre-authorization

Pre-authorization is a key step before receiving dentures.

- Your dentist sends treatment plans to your insurer.

- The insurer reviews and confirms coverage details.

- You receive a clear view of covered expenses.

Ensure to get pre-authorization to avoid surprise bills. This helps manage your finances effectively when planning for denture treatment.

Credit: myfamilylifeinsurance.com

Crucial Factors To Consider When Choosing A Plan

When it’s time to pick a dental insurance plan for dentures, certain factors stand out. You must weigh options carefully to ensure your choice meets your dental health needs. Your smile depends on it. Below, let’s explore these factors to guide your decision-making process.

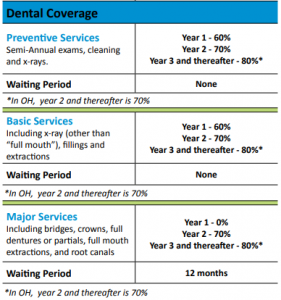

Waiting Periods And Benefit Periods

Insurance plans often have waiting periods before benefits kick in. This means, after sign-up, you could wait several months to a year before using denture coverage.

Understand the benefit period, too. It’s the time when services are covered. Look out for plans with year-round coverage to avoid surprise out-of-pocket costs.

The Fine Print: Exclusions And Limitations

Read the fine print carefully for what’s covered and what’s not.

- Check for exclusions like pre-existing conditions that can impact coverage.

- Note limitations such as caps on the number of denture replacements.

- Look for clauses about cosmetic dentistry, often not covered.

Choosing the right dental insurance for dentures requires attention to detail. Analysing these factors helps ensure you find a plan that aligns with your needs.

Additional Ways To Afford Your Dentures

Finding ways to manage the costs of dentures can be challenging. Let’s explore options to make this necessary dental work affordable.

Negotiating With Dentists

It’s often possible to lower your denture costs through negotiation. Dental professionals understand their treatment’s financial impact and may offer flexible pricing. Follow these steps:

- Ask upfront about price adjustments.

- Compare prices with other local dentists.

- Explain your budget clearly and politely.

- Look for newly established clinics that might offer better deals to attract new patients.

Exploring Dental Discount Programs

Dental discount plans can significantly cut costs.

- You pay an annual fee to join.

- Receive discounts ranging from 10% to 60% on various procedures.

- Choose a plan that covers denture services.

Remember to check:

| Item | What to Look For |

|---|---|

| Provider options | Network of accepting dentists |

| Coverage details | Percentage of denture costs saved |

| Exclusions or limits | Ensure no hidden restrictions |

Credit: freshdentalnc.com

Credit: patuxentorthodontics.com

Frequently Asked Questions Of Best Dental Insurance For Dentures

What Factors Affect Denture Insurance Costs?

Dental insurance premiums for dentures can vary based on coverage limits, deductible amounts, the insurance provider, and whether the plan includes partial or full dentures.

How Does Dental Insurance Cover Dentures?

Dental insurance typically categorizes dentures as a major procedure, offering partial reimbursement after a waiting period, and may not cover the entire cost.

Are Dentures Covered Under Basic Dental Plans?

Most basic dental plans do not include dentures; they are generally covered under more comprehensive or specialized dental insurance options offering major procedure coverage.

Conclusion

Selecting the right dental insurance for dentures can significantly ease your financial burden. Consider the coverage specifics, out-of-pocket costs, and ease of claim processes. Remember, the best plan offers a balance between comprehensive coverage and affordable premiums. Your smile’s future depends on making a wise choice now.

Choose wisely, and smile with confidence!