Dental insurance typically covers preventive care, such as cleanings and exams. It often extends to basic procedures like fillings and extractions, and may partially cover major services like crowns.

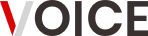

Understanding dental insurance is crucial for maintaining oral health without financial strain. These plans are designed to ensure that routine check-ups and necessary dental work remain affordable. By offsetting the costs of standard dental care and contributing to more complex procedures, insurance reduces out-of-pocket expenses.

Dental coverage varies by provider and plan, with many offering different tiers of coverage that balance premiums with the extent of benefits. A thoughtful selection of dental insurance can play a pivotal role in both oral hygiene and financial well-being, making it a smart investment for individuals and families prioritizing health. Choosing the right plan requires evaluating personal dental care needs against the specifics of policy offerings to find the coverage that best suits your situation.

Decoding Dental Insurance Coverage

Understanding dental insurance can save you time and money. Let’s decode what these policies usually cover. Knowing the details can help keep your smile bright without financial surprises.

Types of Dental Insurance Plans

Types Of Dental Insurance Plans

Dental insurance plans come in various forms. The right one for you depends on your needs and budget. Below are the common types:

- Preferred Provider Organizations (PPOs): You choose a dentist from a network for better rates.

- Health Maintenance Organizations (HMOs): They offer lower premiums and have a list of providers.

- Indemnity Plans: These plans allow you to visit any dentist and pay a consistent fee.

- Discount Plans: This is not insurance but provides discounts from certain dentists.

Standard Inclusions in Dental Policies

Standard Inclusions In Dental Policies

Most dental policies include a mix of services. The extent of coverage can vary, but common inclusions are:

| Service Type | Usually Covered Percentage |

|---|---|

| Preventive Care | 80-100% |

| Basic Procedures | 50-70% |

| Major Procedures | 50% or less |

| Orthodontics | Coverage varies |

Preventive care often includes cleanings, exams, and X-rays. Basic procedures might cover fillings and extractions. Major procedures can include crowns, bridges, and root canals. Orthodontics may or may not be covered, depending on the plan.

Preventive Care Benefits

Preventive Care Benefits are essential for healthy teeth and gums. Good dental insurance covers services that protect your mouth. It helps you avoid cavities, gum disease, and other dental problems. These benefits save you money in the long run. They keep your smile bright and healthy. Let’s explore how preventive care works with dental insurance.

Routine Exams And Cleanings

Regular check-ups are key to stopping dental issues before they start. With dental insurance, routine exams are often covered. Insurances may pay for two check-ups per year. During these exams, a dentist checks your teeth and gums. They spot small problems early. This helps to fix issues before they become big.

Cleanings are also part of preventive care. Professional teeth cleaning removes plaque and tartar. This can’t be done at home. Dental hygienists use special tools for this job. Most dental plans include at least two cleanings each year. These cleanings prevent decay and gum disease.

X-rays And Fluoride Treatments

X-rays let dentists see problems not visible during a regular exam. These can show cavities between teeth or problems below the gum line. Dental insurance typically covers X-rays as part of preventive care.

Fluoride treatments strengthen tooth enamel. They can prevent tooth decay. These treatments are often part of dental insurance for kids. Some plans cover adult fluoride treatments, too.

| Service | Coverage | Frequency |

|---|---|---|

| Exams | 100% | 2 per year |

| Cleanings | 100% | 2 per year |

| X-Rays | 100% | As needed |

| Fluoride Treatments | Varies | Usually 1 per year |

Basic Procedures: Intermediate Care

When discussing dental insurance, understanding coverage for basic procedures is key. These are not your regular check-ups and cleanings, but rather intermediate care that may be necessary for good oral health. Dental insurance often categorizes treatments into preventive, basic, and major services. Under the ‘Basic Procedures’ category, patients can find a range of treatments partly covered by their plans. Let’s explore key services like fillings, emergency care, root canals, and extractions.

Fillings And Emergency Care

Dental fillings repair cavities and restore tooth function. Insurances typically cover a significant portion of the cost for this procedure.

Emergency care addresses sudden dental pain or accidents. Insurance plans can help reduce the financial burden during these pressing times.

- Amalgam (silver) fillings

- Composite (tooth-colored) fillings

- Standard care for a broken tooth or lost filling

Root Canals And Extractions

Root canals treat infected or decayed teeth. This process involves removing the afflicted nerve and pulp, then sealing and protecting the tooth. Extractions involve the complete removal of a tooth, often due to severe decay or damage. Dental insurance typically helps cover a percentage of the cost for both these types of procedures.

| Procedure | Coverage |

|---|---|

| Root Canal | Policy-dependent, usually a significant portion |

| Extraction | Ranges from simple to surgical, with variable coverage |

Credit: myfamilylifeinsurance.com

Major Dental Work Coverage

Dental insurance often covers major dental work. This includes procedures like bridges, crowns, and dentures. It may also cover orthodontics and prosthodontics. Coverage can vary.

Coverage details are vital. Plans differ greatly. Always check the policy.

Bridges, Crowns, And Dentures

Dental bridges, crowns, and dentures restore smiles. They are often costly.

- Bridges replace missing teeth.

- Crowns protect weak teeth.

- Dentures are false teeth sets.

Insurance often covers a part of these costs. Plans usually pay 50%.

Orthodontics And Prosthodontics

Orthodontics straightens teeth. Braces are common examples.

Prosthodontics includes implants. It restores function.

| Treatment | Coverage |

|---|---|

| Braces | Partial coverage |

| Implants | Varies by plan |

Many plans have a waiting period. Check before treatment.

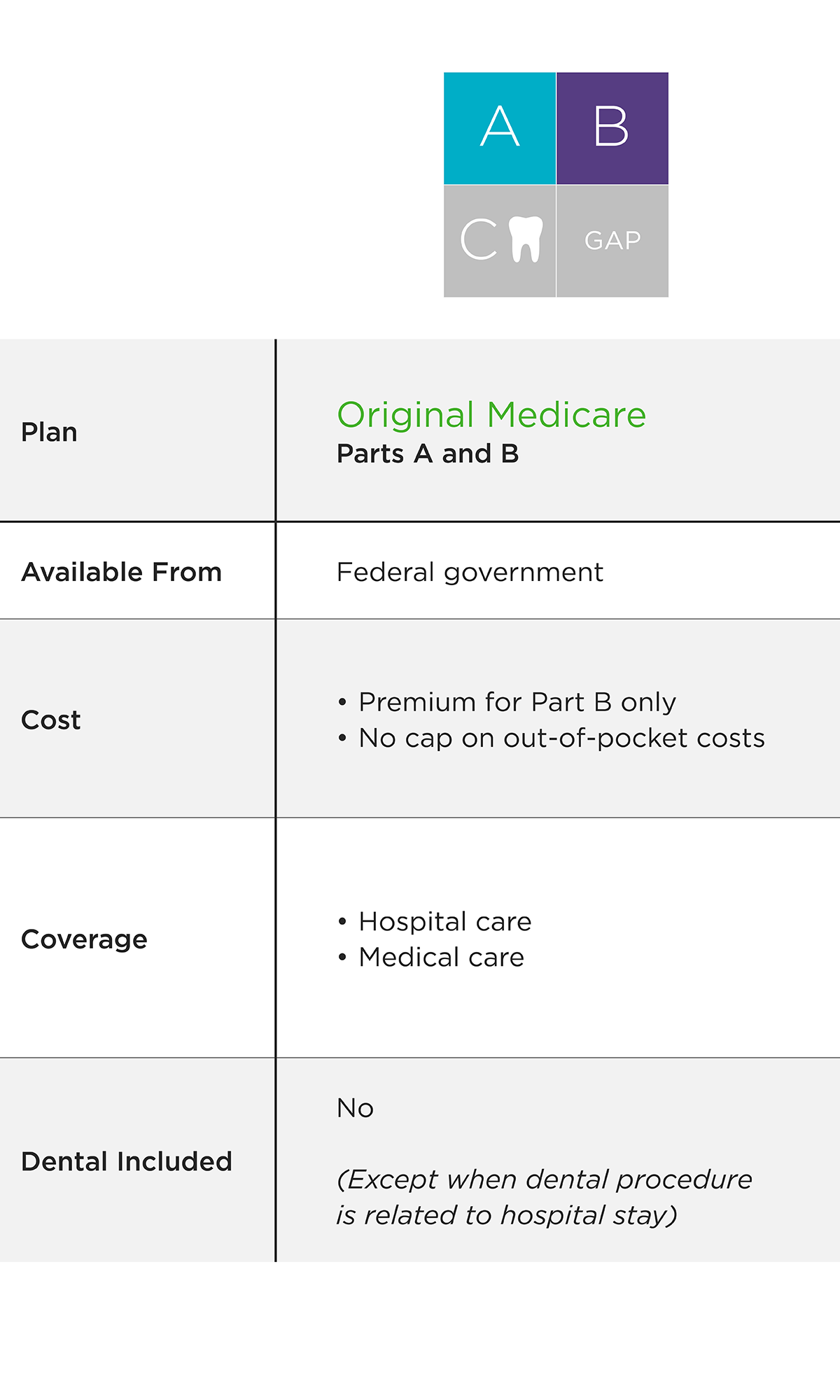

Limits And Exclusions To Consider

Understanding the limits and exclusions of dental insurance is crucial. It ensures that you are not caught off guard by unexpected costs. Dental plans often include specific boundaries and items they do not cover. Let’s explore what to watch out for in your dental insurance policy.

Annual Maximums And Deductibles

Dental plans usually have an annual cap on how much they will pay for your dental care. This is known as your annual maximum. Once you reach this limit, you will need to pay for any additional dental care out of pocket until the next policy year starts.

Most plans include a deductible. This is a set amount you pay before your insurance starts to cover costs. Lower monthly premiums can mean higher deductibles. Therefore, it is important to find a balance that works for your budget.

Pre-existing Conditions And Waiting Periods

Pre-existing conditions are dental issues you had before starting a new insurance plan. Many dental insurance policies do not cover these conditions immediately. Coverage for such conditions may introduce waiting periods.

- Waiting periods can range from a few months to over a year.

- During this time, you must maintain the insurance but you do not receive benefits for certain procedures.

This is designed to prevent people from only buying insurance when they need expensive treatments. Always check for these clauses in your insurance contract.

Credit: www.deltadental.com

Credit: www.dentalinsuranceshop.com

Frequently Asked Questions On What Do Dental Insurance Cover

Does Dental Insurance Cover Orthodontic Treatment?

Dental insurance may cover part of the cost for orthodontic treatments such as braces, but coverage varies by plan.

Are Routine Cleanings Covered By Dental Insurance?

Yes, most dental insurance plans typically cover routine cleanings either fully or partially as preventive care.

Is Tooth Extraction Covered Under Dental Insurance?

Tooth extractions are usually covered by dental insurance, especially if deemed medically necessary, but coverage levels differ among policies.

Conclusion

Navigating dental insurance can be complex, yet understanding the coverage is vital. Most plans typically include preventive care, basic procedures, and emergencies. They might limit or exclude cosmetic treatments. Our smiles are investments worth protecting, so selecting the right dental insurance is essential.

Always review policy specifics to ensure your oral health needs are fully addressed.