Guardian Dental Insurance provides dental coverage to individuals and employers. Their plans offer access to a large network of dental professionals.

Guardian Dental Insurance is known for its diverse range of dental benefits, designed to meet the needs of both individual policyholders and employee groups. With a focus on preventive care, Guardian encourages regular dental check-ups to maintain overall health. The coverage options can include basic procedures like cleanings and X-rays, as well as more advanced treatments such as orthodontics and oral surgery.

Guardian’s user-friendly platform makes it easy for members to find a dentist, view benefits, and track claims, enhancing the customer experience. Their commitment to affordability and quality care makes Guardian a competitive choice for dental insurance in the marketplace.

Credit: www.lahap.org

Diving Into The Basics Of Guardian Dental Insurance

Exploring the Essentials of Guardian Dental Insurance can simplify smiles and budgets across the country. This section shines a light on what Guardian Dental Insurance is and the variety of plans to choose from. Understanding these basics helps individuals and families make informed choices for their oral health care needs.

What Is Guardian Dental Insurance?

Guardian Dental Insurance is a tool for managing dental care costs. It offers financial support for various dental services. Members pay a monthly premium. In return, they get access to a network of dentists and reduced rates on services.

Types Of Plans Offered

Guardian Dental caters to diverse needs with multiple plan options:

- DHMO: Affordable, with set fees, and a primary care dentist manages treatments.

- PPO: Flexibility to choose any dentist, with potential savings when staying in-network.

- Indemnity: Freedom to visit any dentist, typically with higher out-of-pocket costs.

Credit: www.mdentalsmiles.com

Evaluating Guardian’s Coverage Options

Choosing the right dental insurance can be like picking the perfect toothbrush. It has to fit just right! Let’s chew over Guardian Dental Insurance coverage and see if it’s the key to your smile-worthy oral health.

Dental health care is no minor feat. Your chompers deserve the best. Guardian offers coverage options catering to various needs. We highlight two key components to consider.

Preventative Care Benefits

Staying on top of dental health keeps your teeth gleaming and your wallet happy. Guardian shines with their preventative care.

- Biannual check-ups: Early detection is the trick to nipping dental issues in the bud.

- Cleanings: Polishing those pearly whites not only looks good but also keeps decay away.

- X-rays: You can’t fix what you can’t see. Guardian has your back with essential imaging.

Remember, guarding your oral health is a proactive game with Guardian’s preventative perks.

Coverage For Major Dental Work

Sometimes dental care requires the big guns. Guard your savings with Guardian’s coverage for major work.

| Procedure | Coverage % | Waiting Period |

|---|---|---|

| Crowns | 50% | 6 months |

| Implants | 50% | 6 months |

| Dentures | 50% | 6 months |

Major dental procedures need not be a major worry. Guardian’s insurance options are structured to support you through these experiences.

Understanding Costs And Affordability

Choosing dental insurance involves looking at costs. You want to keep your smile bright without emptying your wallet. Guardian Dental Insurance offers various plans. Understanding the costs is key. Let’s dive into premiums and deductibles. We’ll also compare costs with coverage benefits.

Premiums And Deductibles Explained

Two important terms in dental insurance are ‘premiums’ and ‘deductibles’. Premiums are regular payments you make for your insurance. They can be monthly or annually. Deductibles are amounts you pay out-of-pocket before insurance kicks in. Lower premiums might mean higher deductibles, and vice versa. It’s crucial to find a balance suited to your needs and budget.

| Plan | Premium | Deductible |

|---|---|---|

| Basic | Lower | Higher |

| Comprehensive | Higher | Lower |

Knowing what each plan offers helps you predict costs better. Let’s consider value and coverage next.

Finding Value: Cost Vs. Coverage

Seeking the best value means weighing cost against coverage. Start by listing what services you need like cleanings, fillings, or braces. Plans often cover different services. Match your needs with the right plan.

- Basic plans are more affordable but cover less.

- Comprehensive plans cost more but offer wider coverage.

Guardian Dental provides options that balance these aspects. It’s all about getting maximal benefit for your investment. Here’s a breakdown:

- Review coverage details: Look at what services are included.

- Assess usage frequency: How often you’ll use the insurance.

- Calculate potential savings: Compare paying out-of-pocket versus with insurance.

Choose a plan that maximizes what you get for what you spend. The right coverage at an affordable cost is within reach with Guardian Dental.

Maximizing Benefits With Guardian

Understanding your Guardian Dental Insurance plan unlocks a world of savings and dental health benefits. It is time to explore how to get the most out of Guardian’s offerings. This section helps policyholders maximize plan advantages to ensure healthy smiles without breaking the bank.

Making The Most Of Your Plan

Dig into the details of your Guardian Dental Insurance coverage. Know routine procedures covered at 100%. Ensure you keep regular oral exams and cleanings to prevent costly treatments later. Utilize the free resources Guardian provides. They guide you in maintaining dental health and avoiding extra expenses. Stay within the Guardian network of dentists. Doing so often results in lower out-of-pocket costs.

Tips For Using Your Dental Insurance

- Schedule Preventive Care: Use your two yearly check-ups, as preventive services are usually fully covered.

- Understand Your Plan: Read your benefits booklet carefully. Grasp the specifics of your coverage and policy limits.

- Plan for Major Procedures: If anticipating major dental work, time it to maximize your annual benefits.

- Ask about Pre-Authorizations: For expensive treatments, verify whether Guardian requires a pre-authorization. This ensures coverage and avoids unexpected costs.

- Use In-Network Dentists: In-network providers agree to reduced rates, saving you money.

- Consider Flexible Spending Accounts (FSA) or Health Savings Accounts (HSA): Combine these accounts with your dental insurance to pay for eligible expenses.

Always remember to renew your coverage on time to maintain continuous benefits. Keep your smile bright and your dental costs low with Guardian.

Navigating Policy And Claims

Understanding your Guardian Dental Insurance policy and how to manage claims can seem daunting. No need to worry. Clear steps guide you through filing claims and resolving disputes. Let’s dive in and make sure you get the most out of your dental coverage.

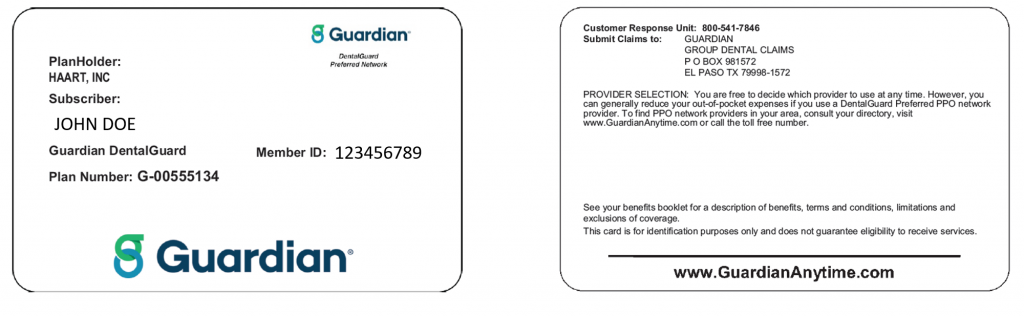

How To File A Claim

Filing a claim with Guardian Dental Insurance should be quick and stress-free. Follow these simple steps to ensure your dental treatments are submitted correctly:

- Get your dental care from a licensed dentist.

- Collect important documents like detailed bills or treatment summaries.

- Log into Guardian’s online portal or use their mobile app.

- Complete the claim form and attach any required documents.

- Submit your claim online or mail it if preferred.

Dealing With Coverage Disputes

At times, you might disagree with what your Guardian Dental Insurance covers. Here’s a step-by-step approach to handle these situations:

- Review your insurance plan carefully to understand the coverage.

- If unclear, call Guardian’s customer service for clarification.

- Gather evidence that supports your claim, including dental records.

- File an appeal if you believe a mistake has been made.

- For unresolved disputes, consider a third-party mediator.

Credit: www.guardianlife.com

Frequently Asked Questions Of Guardian Dental Insurance

Does Guardian Offer Family Dental Plans?

Guardian Dental Insurance provides various dental plans, including options for families seeking comprehensive dental coverage to meet their specific needs.

Can I Find In-network Dentists With Guardian?

Guardian connects members with a wide range of in-network dentists, ensuring affordable care and a selection of skilled professionals for quality dental services.

What Does Guardian Dental Insurance Cover?

Guardian Dental Insurance typically includes preventive care, basic procedures, and major services, but coverage details vary with each plan’s specifications.

Conclusion

Wrapping up, Guardian Dental Insurance offers solid coverage options for diverse dental care needs. It’s a choice worth considering for reliable oral health support. Weigh your options, and remember, a healthy smile is a valuable asset. Embrace a plan that ensures your teeth are well-taken care of.